Is 2021 The Most Important Year Ever For Your Brewery To Win A Medal?

by

Sam Holloway, Ph.D.

With comments from Breakside Brewing (Portland, OR USA), Brewery Deseveaux (Boussu, Belgium), Engkanto Brewery (NCR Manila, Philippines), Antwerpse Brouw Compagnie (Antwerp, Belgium), and the Brussels Beer Challenge (Brussels, Belgium)

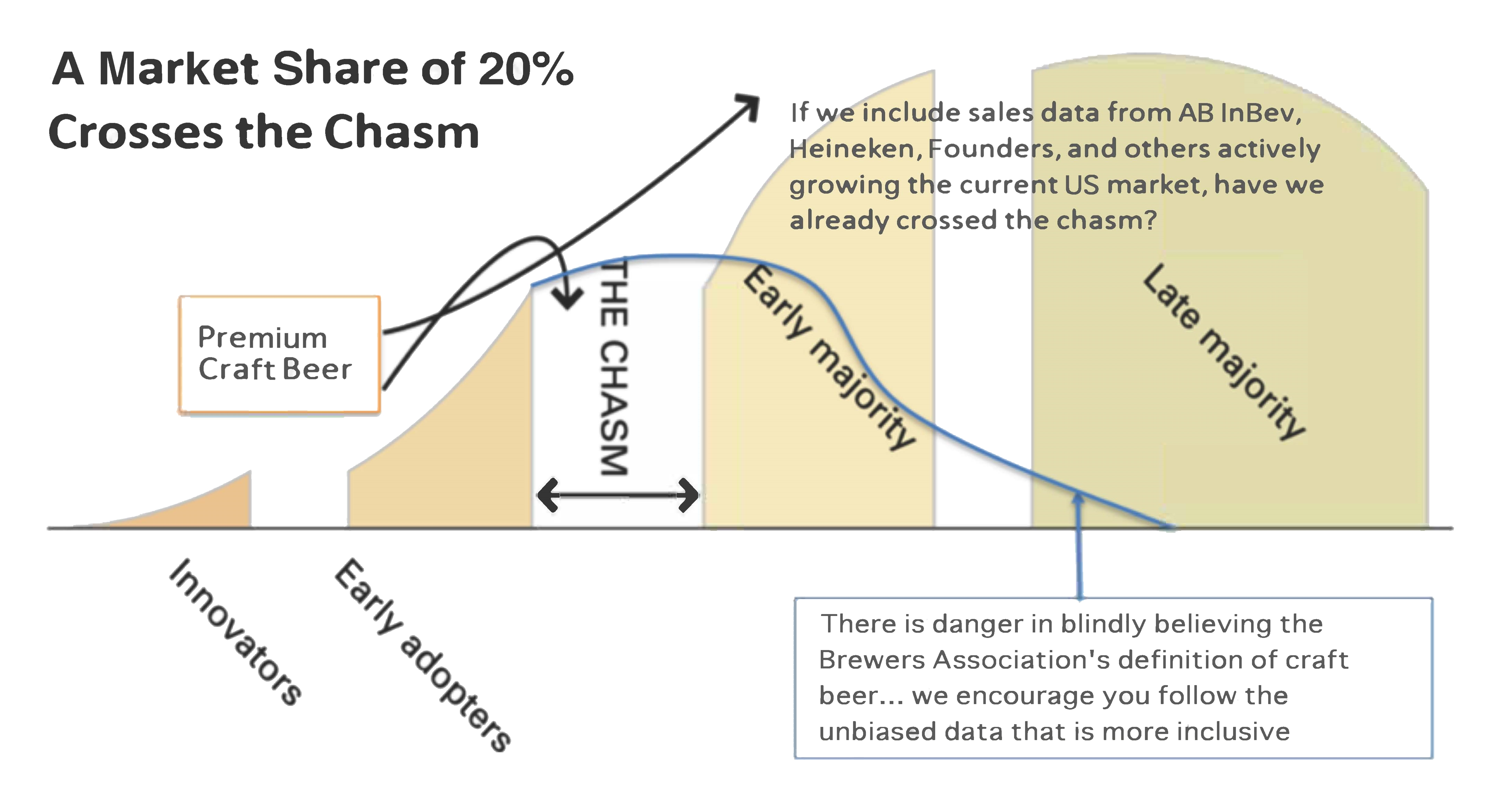

I’ve spent most of my time this year thinking about bringing new customers into craft beer. Whether you are in North America, Australia, Asia, or Europe, the global pandemic has caused us to re-evaluate every aspect of our businesses. Today I want to examine the role beer competitions should play in your strategy. Here’s my conclusion: It’s never been more important for breweries to participate in beer competitions and to win competition medals. Smart breweries need to consider three things in making their decisions:

- How exclusive is the competition, do they have high enough standards to justify the costs of entry (entry fee, time, marketing, travel, etc.)?

- Do consumers understand the value of a win and are you prepared to dedicate resources to tell them about your success (or failure)?

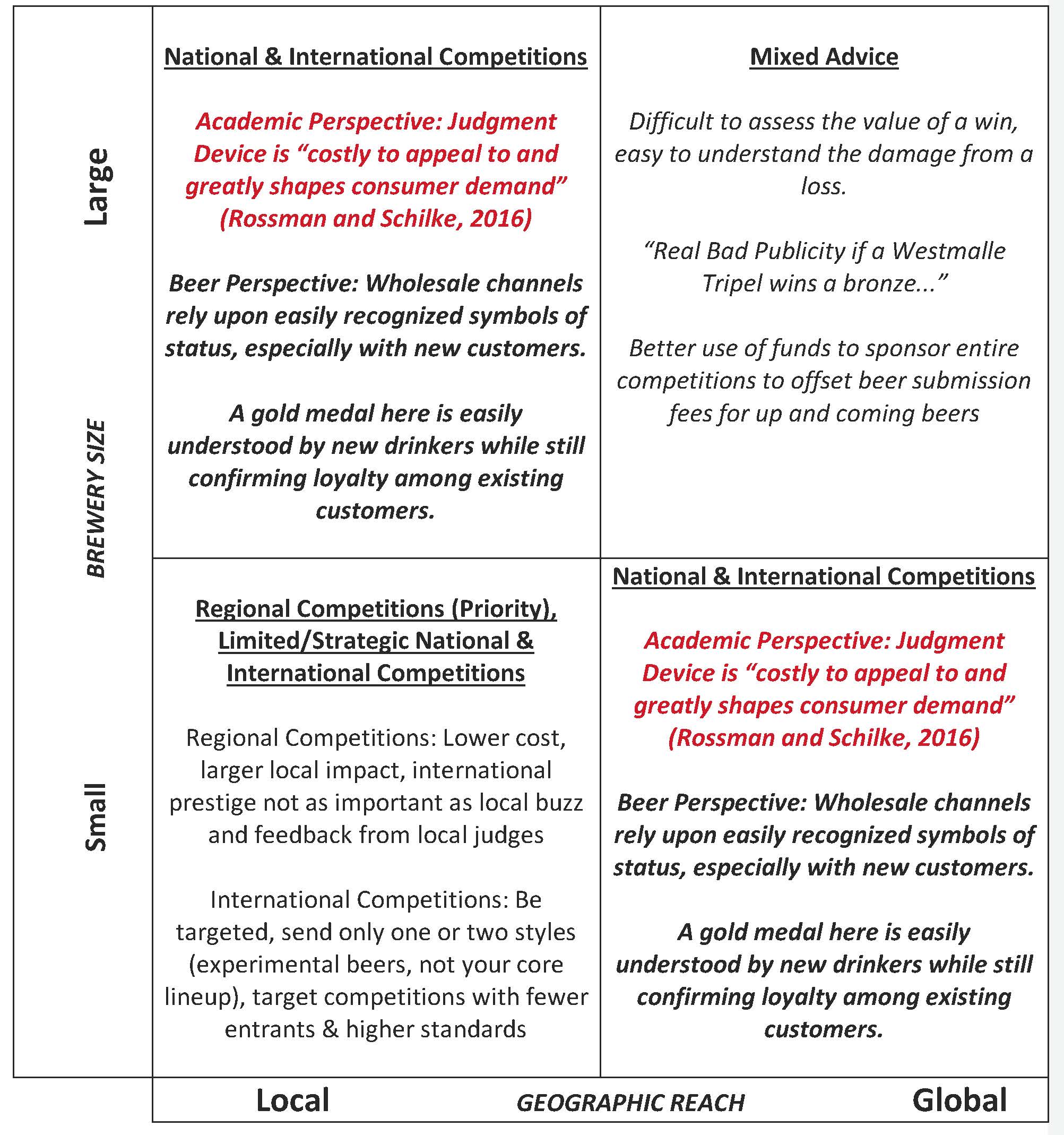

- With so many new competitions, how do you choose the right ones? {Hint, it depends on two factors – the size of your brewery and the geographic reach of your sales. We offer a 2x2 matrix at the end of this blog to help you choose the right competitions}

“New beer drinkers don’t necessarily have the education to understand the flavor nuances of yeast strains or hop profiles, but everyone knows what a gold medal is." Dr. Ian Parkman, University of Portland (USA)

The current relationship between craft breweries and new craft drinkers is dangerous in many ways. Much like the wine industry in 2001, current craft beers require a lot of education on the part of consumers for them to feel confident in their purchase decisions. Back in 2001, wine industry messages focused on the land the wine grapes were grown in (terroir), the prestige of the winemaker, the complexity of the wine, and wine labels often had a chateau on them, even if there was no chateau on the property itself. For new wine drinkers this was an intimidating place – and many potential new customers simply opted out of wine altogether so they wouldn’t look stupid during their purchase experience.

Prior to the pandemic, it was OK for breweries to expect a fair bit of education among beer drinkers because we had the infrastructure in place to educate them. Wholesale sales reps were trained on the nuances of the beers they sold and were incentivized to continue learning about their products and thus, incentivized to teach their buyers. Beer drinkers visiting taprooms (pre-pandemic) could use servers and brewers as an interactive resource library and grow their knowledge in a safe and fun atmosphere. Post-pandemic, we will certainly love to reopen our taprooms and educate new beer drinkers as they visit, but what about all the Direct To Consumer (DTC) sales and mobile ordering features we’ve implemented during the pandemic? Don’t we all love those new channels and their higher margins? If you’ve made a big bet on mobile and you want to grow this channel, which one of these two options will be most successful on those small screens?

- A list of hop profiles, aromas, and technical brewing statistics that requires three screen scrolls to get to the “buy now” button

- A giant picture of a recent gold medal on the first screen with a “buy now” button

Amazon has made billions by displaying information on a single screen with one click purchase functionality. They don’t use words, rather they use images, symbols and videos. Beer drinkers new and old expect this kind of functionality and get frustrated when it isn’t there. Can a gold medal from a prestigious beer competition signal quality and drive sales for your brewery? Let’s ask some of the world’s most prominent academics and brewers what they think heading into 2021 and beyond.

Academic Science

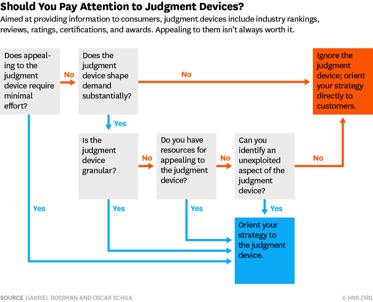

The academic science below isn’t beer specific, but it does offer a place to start. Check out this flow chart and blog from Professors Gabriel Rossman and Oliver Schilke, How Ratings and Awards Do (and Don’t) Benefit Companies (via Harvard Business Review). Hint: They Refer to Award Competitions and Ratings as “Judgment Devices.” {Image Credit: HBR.org}

International Beer Industry Experts’ Opinions

OK, with the academics behind us, it still isn’t crystal clear how and why craft breweries should enter their beers into competitions. I reached out to my friend and founder of the Brussels Beer Challenge, Luc de Raedamaeker to ask him why breweries do and don’t enter beer competitions:

Luc de Raedamaeker, Director, Brussels Beer Challenge:

In my experience brewers are generally entering for three reasons:

-

Win an award and use it as a marketing tool

-

Benchmark your beers and get feedback on their beer (especially small and starting breweries or well established breweries with new products)

-

To support the industry (this is an underestimated motivation).

Brewers don’t register for the following reasons:

-

Too expensive

-

They don’t find the time/or forget to do it

-

Large/successful breweries don’t want to lose their status: Example, it’s real bad publicity if Westmalle Tripel wins a bronze award.

Ben Edmunds, Brewmaster at Breakside Brewing (Portland, OR) had this to say:

Any well-run beer competition should, at a minimum, provide brewers with feedback about how their beers fared in a blind setting. After all, as anyone who enters competitions know, you lose more than you win, so it's the feedback, and not the glory that you're really after. Sending beer to international competitions such as the Brussels Beer Challenge has become more and more important for a brewery like Breakside because it gives us that valuable feedback from skilled judges outside of our regional orbit.

Sébastien Deseveaux, CEO & Brewmaster of Brewery Deseveaux (Boussu, Belgium) had this to say:

Participating at Brussels Beer Challenge is important to us, our beers are judged by selected professionals and known for their skills. The majority of the breweries that participate are very old and famous. For each of our beers we receive a detailed evaluation which reveals the important characteristics, after which it is up to us to develop them if necessary. We have won a Gold medal 3 times in the Traditional Season category, which is a great honor for us and a great recognition of the work of my team.

Johan Van Dyck, Founder of Antewerpse Brouw Compagnie (Antwerp, Belgium) had this to say:

As a small independent craft brewery, quality is our key differentiator. We cannot compete on price, nor on heavy marketing or elaborate sales teams. We therefor invest heavily and put all our focus to pushing our quality to the highest level, as we are convinced this is the only long term valid strategy. The Brussels Beer Challenges is part of this philosophy: it gives us an objective neutral ‘external’ quality audit on our beers and in comparison, to competition from all over the world. Judged by an experienced and diverse team of judges.Winning a medal is a real boost for our brewers and confirms the efforts invested. While this is our main reason for entering, winning a medal at the BBC put your brewery and beers on the radar of many beer lovers, beer buyers across the country and world. They know that a BBC medal has actual value and is a true proof of quality. This way, the BBC is a part of our drive for top quality, and serves as an ambassador for our philosophy.

Conclusion

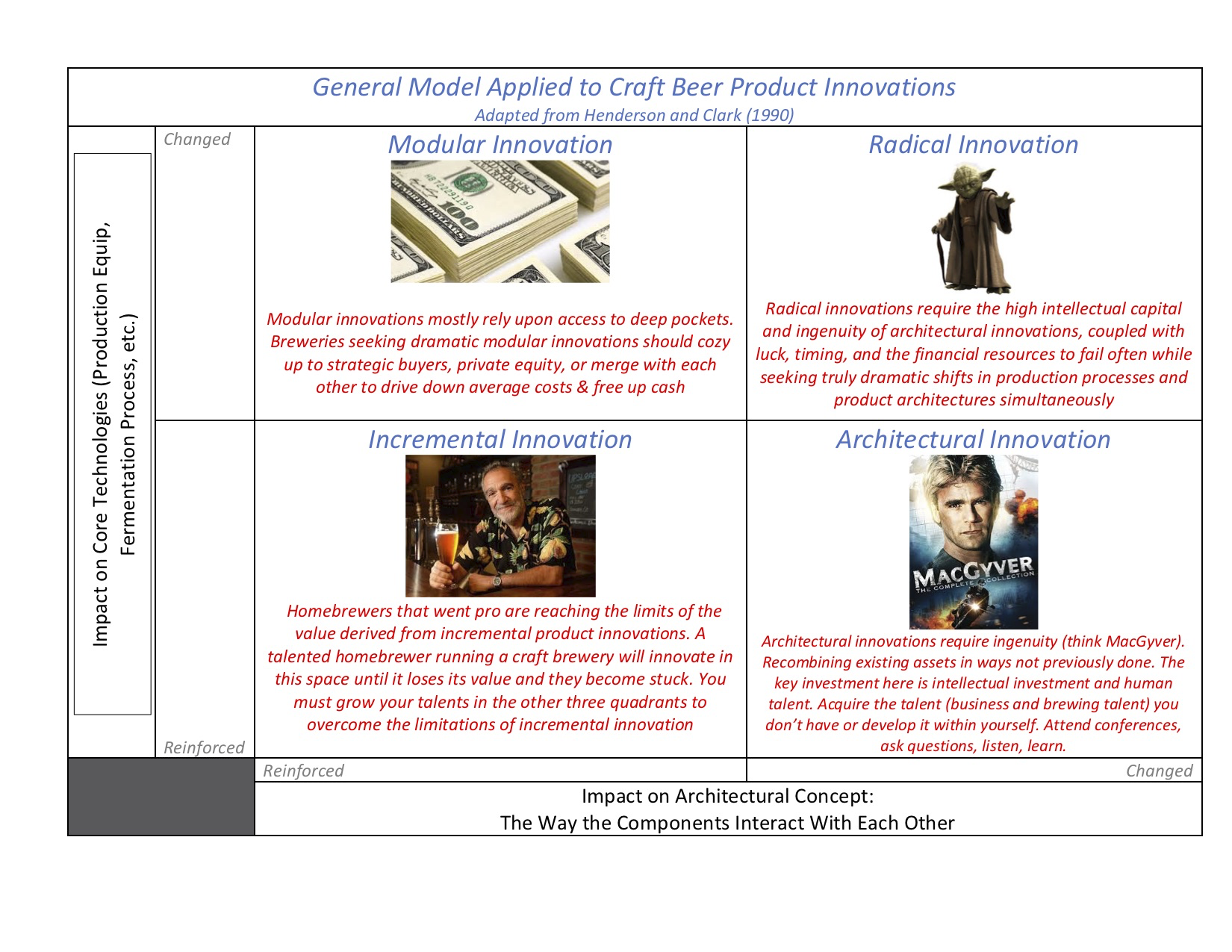

Based on the feedback from some prominent minds in the global craft beer scene, I’ve concluded it’s never been more important for breweries of all sizes to enter beer competitions. Most small breweries don’t have the budget to enter everything, thus you need to be selective. Here is a 2x2 matrix of beer competition strategies based on what kind of brewery you are.

&nbso;

Note On Emerging Markets

From CAS Member Expert Michael Jordan, Brewmaster at Engkanto Brewing, Philippines

The perspective you share in this blog makes a lot of sense for America ( or other mature craft markets). For craft breweries in emerging markets the situation is much different. In these new markets people tend to trust and place a higher value on international brands. A way to change their perception is to win international beer awards to convince them that locally made craft beer is on par with “famous” international brands. I saw this in China during my 10+ years there and I am seeing it again in the Philippines. This strategy worked very well in China and is likely the case for all of Asia.