Recent Blog Posts

- Is 2021 The Most Important Year Ever For Your Brewery To Win A Medal?

- Creating New Demand In 2021 and Beyond

- What Does Sweetwater Brewing Company’s Sale Mean For Most Small Breweries?

- A Helping Hand For Cash Strapped Breweries

- Has Craft Beer Flavor Innovation Played Itself Out?

- Brewery Staff Attire

- Craft beer is NOT depressed, but the Brewers Association may be...

- Nailing the Basics: Inventory for a Brewery

- Has the BA Become Too Big to Succeed?

- Making Sense of the Revised Craft Brewer Definition

- Two Weeks That Changed My Brewery's Strategy

- Don't Get Stuck in the Middle: European Ownership, Flagship Strategies, & Craft Beer Market Growth

- Goodwill Can Be an Asset for Your Brewery

- Update on Craft Beer in Australia

- 12 NW Whiskeys Reviewed

Submitted by

SUBMITTED BY Lenny Gotter ON Tue, 04/26/2016 - 04:42

Note from CAS President, Sam Holloway: About once per month I get asked if CAS can help distilleries. The truth is, I’m not sure. It’s hard enough for me to keep current on the beer industry, but I also know that craft distilleries need a voice and need access to business wisdom. I’m thrilled to announce our newest Member Expert Blogger, Lenny Gotter. Lenny founded Eastside Distilling and took that company from an idea inside his own head into a publicly traded and industry leading craft distillery. Lenny has literally “done it all” in distilling and he approached me with a desire to give back. I’d like to personally thank Lenny for being in our community the past year or so, for seeing a need to give advice on distilleries and business strategy, and stepping up to lend his voice to our community. This initial blog is publicly available and shareable, future blogs will be exclusively for our membership.

Lenny Gotter, Member Expert – Founder, Eastside Distilling & Lenny Gotter Brand Consulting Services

April 24, 2016

Owning a local distillery is something to be proud of, for you can supply your neighbors with the libations they need to celebrate life events. Bringing joy to people is a Pro in being a distillery owner, and naturally one of the most stressful Cons is taxes. I know the sheer mention of taxes can bring one to drink, but before you fill your shot glass just know for the past few years, we craft spirits business professionals have been working hard with our elected officials to get a craft distillery tax break in Federal Excise Tax (FET). Several local distillers of Distillery Row and I met with Congressman Bleumenaur in the summer of 2010. We were expressing the need for this tax break to ensure the survival of local distilleries, and after many years, the prospect of a tax reduction similar to what is already enjoyed by the craft beer and wine industry is a possibility.

According to the Alcohol and Tobacco Tax and Trade Bureau (TTB), if you are a small alcohol excise taxpayer who has paid less than $50,000 in beer excise tax in the previous year, you may be eligible to file returns and pay excise taxes on a quarterly basis. So cheers to that! However, if you exceed $50,000 in a calendar year, which is only 3700 proof gallons or roughly 2000 cases, you must pay semimonthly instead of quarterly.

Grab a bourbon on the rocks, pull out a chair, and allow me to break it down for you. When a distillery grows to approximately 2000 cases per year their federal tax is due semimonthly instead of quarterly. Taxes on products that leave your bonded space, some of which not being sold yet, from January 1st thru the 15th will be due on January 21st. What this means is you will pay tax on a product that you may not receive payment for weeks or months. The tax paid in advance increases so much that it becomes an asset on your balance sheet. A huge amount of operating capital becomes tied up in tax payments instead of growing your business. I cannot stress what an enormous cash drain this is and how it can increase as your business grows.

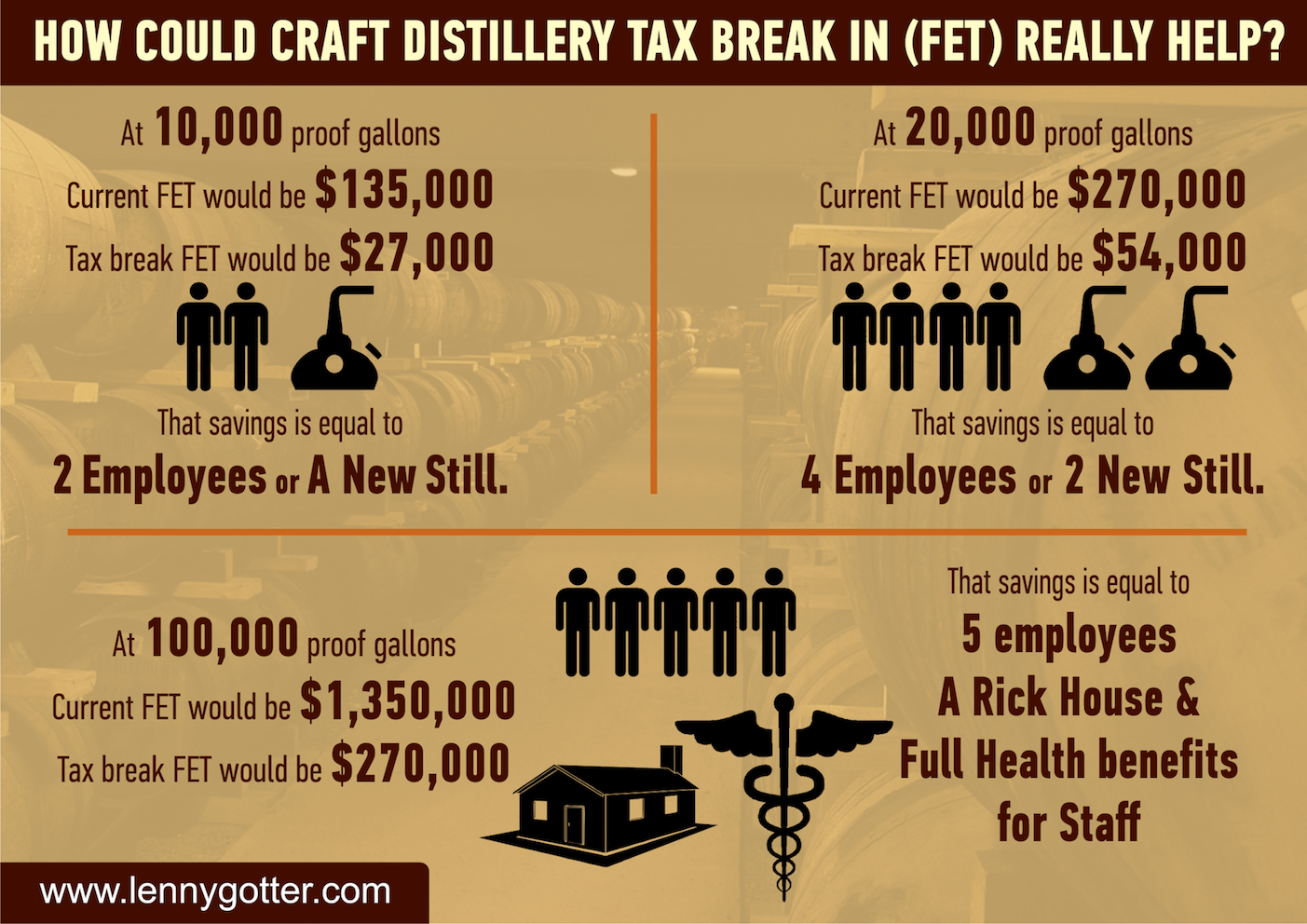

How could this tax break really help?

At 10,000 proof gallons, current FET would be $135,000, and the tax break FET would be $27,000. That savings is equal to two new employees or a new still.

At 20,000 proof gallons, current FET would be $270,000, and with the tax break the FET would be $54,000.

At 100,000 proof gallons, current FET would be $1,350,000, and with the tax break the FET would be $270,000. That savings is equal to five new jobs/employees, a rick house, and full health benefits for staff. Let’s drink to that!

We are pushing to create a bill to receive a 20% FET rate for the first 100,000 proof gallons of any distillery production from $13.50 to $2.70 per proof gallon, and following with a 30% reduction from $13.50 to $9/gallon. Instead of only pertaining to “craft” distilleries, this discount would apply to every distillery, thus giving the bill some chance for success. This FET reduction is a double benefit for small producers; you would have to pay semimonthly at roughly 18,000 cases instead of 2000, and that alone means years of tax relief for small distillers. Time to toast with your favorite spirit for this good news!

This tax benefit has been enjoyed by the craft beer and wine industry for some time now. With this tax break implemented small distilleries will flourish, staff will have better pay and benefits, necessary equipment could be purchased, and all those tax savings will go right back into growing your business and local economy.

We as local distillers deserve tax breaks that will ensure the success of our business.

A new bill in place is beneficial for owners, employees and local economy. So raise your glasses to decades of supplying your townspeople with the Spirits they need at any celebratory occasion.

It’s time we take action to help the growing craft spirits industry and support FET reduction. For more info check out the ACSA FET info page.