Recent Blog Posts

- Is 2021 The Most Important Year Ever For Your Brewery To Win A Medal?

- Creating New Demand In 2021 and Beyond

- What Does Sweetwater Brewing Company’s Sale Mean For Most Small Breweries?

- A Helping Hand For Cash Strapped Breweries

- Has Craft Beer Flavor Innovation Played Itself Out?

- Brewery Staff Attire

- Craft beer is NOT depressed, but the Brewers Association may be...

- Nailing the Basics: Inventory for a Brewery

- Has the BA Become Too Big to Succeed?

- Making Sense of the Revised Craft Brewer Definition

- Two Weeks That Changed My Brewery's Strategy

- Don't Get Stuck in the Middle: European Ownership, Flagship Strategies, & Craft Beer Market Growth

- Goodwill Can Be an Asset for Your Brewery

- Update on Craft Beer in Australia

- 12 NW Whiskeys Reviewed

Submitted by

SUBMITTED BY Mark Meckler ON Wed, 04/09/2014 - 12:59

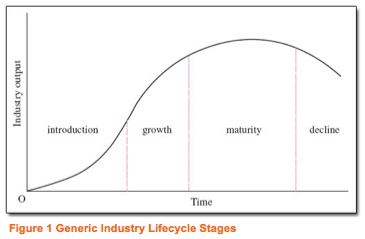

Although the craft beer industry has grown a lot, we are not sure where the craft beer movement is in its lifecycle. Are we on the verge of ending an incredible growth stage? Is the industry getting overcrowded? Is the industry maturing? Or is this just the beginning?

It would be helpful to know because there are certain stages during an industry’s lifecycle when consolidation makes a lot of sense. Furthermore, the recommended business strategies at each stage differ, and timing matters a lot. Business history is littered with those who entered or exited to early or too late, and those who held on too long and those who sold out too quickly.

Most expert bloggers I’ve read peg our industry in the mid to late growth stage, already having turned the corner from an increasing growth rate to a decreasing growth rate. There seems to be a growing consensus among analysts that the craft beer movement is headed into industry maturity.

I think they are wrong. And if they are, it could be damaging to our industry. This does not mean that consolidation isn’t happening; it simply means the some experts are forecasting the wrong consolidation phase. It also probably means they are applying the wrong ideas to an interesting and important problem. My thinking about the craft beer industry is more aligned with the work of technological innovation strategists like Geoffrey Moore, William Abernathy, David Teece, James Utterback, Clay Christensen, and others.

Craft breweries are a disruptive business model and way of thinking, when compared to traditional, “clear beer” corporations. Disruptive business models change the status quo[1] (Christensen, Verlinden, & Westerman, 2002) and bring about new windows of opportunity for entrepreneurs entering the industry (Christensen, Suarez, & Utterback, 1998). This is the kind of sophisticated thinking that should guide our way forward. For the most part, other experts are reading the wrong signals, or maybe they do not realize there are multiple types of consolidation[2]. While I do think a major wave of consolidation is coming, I think the industry is at an entirely different point. Soon after an industry hits the growth stage, it sometimes looks like growth is ending. That is when Geoffrey Moore (1991) famously said it becomes time to “Cross the Chasm.”

Once the Chasm is crossed, a dominant business design (Suarez & Utterback, 1995) is set, and huge growth begins. What is a dominant business design? When all of the business models look the same, and economies of scale are achieved. Currently, we’re just not sure. Is the brewpub or production brewery business model dominant? What about contract breweries? Which business model will allow the industry to cross the chasm into the early majority? According to the Brewer’s Association data, we’re just not there yet. There are now more microbreweries than brewpubs for the first time since 1987. Entrepreneurs are still experimenting, suggesting the dominant business design shakeout is ahead of us.

Our thinking is aligned with another Clay Christensen classic (Christensen, Suarez, & Utterback, 1998), which points out that a major shakeup can occur just before a dominant design is set. This may be the stage that the craft beer industry is just about at now (2014). If so, then the correct strategy for larger breweries with access to financing should be waiting, watching, setting up financing, and getting ready to begin buying up the industry. These large firms are strategically looking to where they might combine production, or simply ramp up production of this brand or that brand to gain the economies of scale.

What about the small craft breweries? Right now, demand is huge relative to supply, and all a craft brewery has to do is produce good beer and it will all sell. Some craft breweries can even produce bad beer and it will sell if there are few other choices. Attention to efficiency and competitive positioning is not absolutely necessary to make a profit. However, a growth-based business model is inadequate when there is surplus supply, competition for shelf space and customers, and price-points start dropping. Those craft breweries that cannot adjust, or simply refuse to will fail. These types of failures – when the business model of a craft brewery does not match the dominant design are called ‘stage-based failures’. If small craft breweries simply ride the wave of popularity they are currently enjoying, and don’t prepare for the next stages, they will risk failure when the rapid growth stage ends and breweries are faced with the new reality of approaching market maturity. I don’t think we are there yet, but the slow train is coming.

What will happen when the slow train arrives? Basic strategy tenets will kick in, and we will begin a process of acquisitions and mergers. On the acquisition side, we will likely see breweries that have advantageous access to cash and credit purchasing breweries that are cash/credit strapped. They do this to gain their valuable resources, such as production capacity, distribution channels and their brands. We will also see the large “clear beer” corporations purchasing their way into the craft beer industry to fill out or freshen their product lines to fit the emerging changes in the tastes of consumers.

There will also be mergers of craft breweries with one another so that they can gain economies of scale. They might be able to share overhead expenses, sales forces and distribution channels. Those who survive will have to become efficient if they want to maintain attractive margins. Small breweries might find that by combining production capacity, they get large enough to attract the important distributors and get access to customers, or large enough to start purchasing inputs in bulk to save money. But the slow train isn’t here, we have to cross the chasm, and then enjoy the ride. However, don’t be complacent and craft a good strategy.

Suggested readings:

http://www.fool.com/investing/general/2013/09/21/can-big-beer-break-into-craft- brew.aspx

http://business.time.com/2013/07/04/too-much-of-a-good-thing-concerns-about- craft-beer-saturation/

REFERENCES

Christensen, C. M., Suarez, F. F., & Utterback, J. M. 1998. Strategies for Survival in Fast-Changing Industries. Management Science, 44(12): S207.

Christensen, C. M., Verlinden, M., & Westerman, G. 2002. Disruption, disintegration and the dissipation of differentiability. Industrial & Corporate Change, 11(5): 955-993.

Moore, G. A. 1991. Crossing the Chasm: Marketing and selling high- tech products to mainstream consumers. New York: Harper Collins.

Suarez, F. F. & Utterback, J. M. 1995. Dominant designs and the survival of firms. Strategic management journal, 16(6): 415-430.